In 2015, nearly 40% of all federal student loan borrowers over the age of 65 were in default, thanks in part to issues they faced when it came to the servicing of their debts, including problems enrolling in income-driven repayment plans and accessing protections as co-signers.

That’s according to a new report [PDF] from the Consumer Financial Protection Bureau that examines the significant increase in older student loan borrowers over the past decade, and how those debts have contributed to financial insecurity.

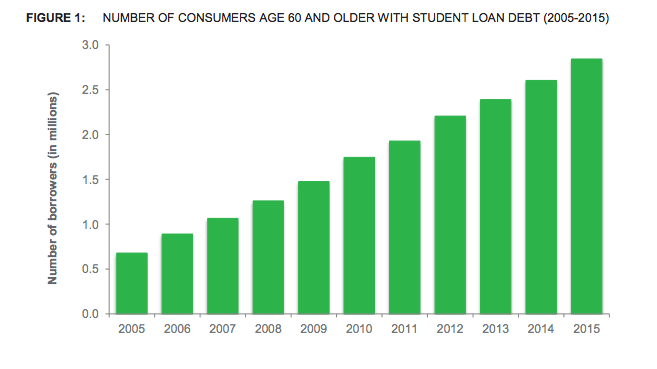

From 2005 to 2015, the number of Americans age 60 or older with one or more student loans quadrupled from about 700,000 to 2.8 million, the CFPB analysis found.

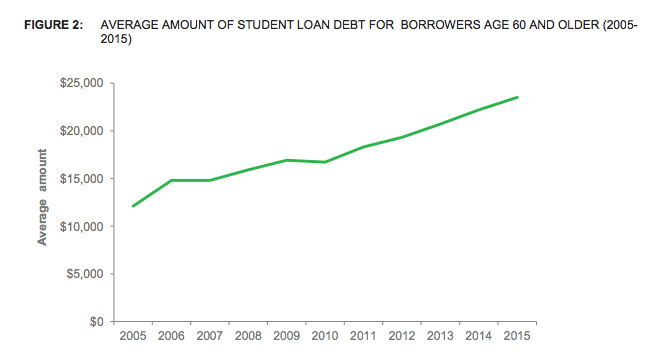

The average debt load owed by an older borrower — either for their own loans or those they cosigned for — roughly doubled in the same time frame from $12,000 to $23,500.

Of that debt, 73% of the borrowers took out the loans for their child or grandchild, while 27% took out the loans for their own or their spouses’ education.

The report found that because older borrowers tend to have a decreased income or fixed-income, they are more likely to default on these loan obligations as time goes on, while younger borrowers have more opportunity to pay back their debts.

In 2015, more than one-third (37%) of federal student loan borrowers over the age of 64 were in default. That default rate dropped to 29% for borrowers 50 to 64 years old, and plummeted to 17% for borrowers 49 years old or younger.

With these hefty tabs and increased likeliness of default, it’s important that older borrowers — or any borrower, for that matter — have access to clear, accurate information about their repayment options.

Unfortunately, consumer complaints received by the CFPB show this isn’t always happening, at no fault of the borrower.

Older borrowers tell the CFPB that many problems arise from, among other things, co-signing private student loans and difficulties accessing protections guaranteed under federal law for many federal student loan borrowers.

The CFPB report identifies four common problems among older borrowers when it came to student loan servicer actions:

• Delaying or prohibiting enrollment in income-driven payment plans: Some federal student loan borrowers report that servicers are not advising them that they may have their loan payment amounts reassessed under an income-driven plan when their income changes.

Borrowers of federal student loans are eligible to enroll in income-driven repayment programs that cap a borrower’s student loan payment at a percentage of their monthly income. Additionally, borrowers who make payments under income-driven plans can have their debts forgiven after a minimum of 20 years of payments.

Instead of being given information on these programs, borrowers tell the CFPB that they are placed in plans designed for borrowers with growing incomes. These issues are similar to those that the CFPB investigated in a Nov. 2016 report that found many qualified students were blocked from participating in affordable loan repayment plans because loan servicers hired by the government failed to enroll them in the plans, despite meeting all the qualifications to do so.

• Incorrectly applying co-signer payments to other loans owed by the primary borrower: Generally, servicers apply payments received across all private student loans owed by the primary borrower.

In some cases, co-signers complained that as a result of this practice they were charged late fees and interest charges, and that these incorrectly deemed late and missed payments were passed on to credit reporting companies.

• Failing to provide borrowers access to loan information: Some co-signers complained to the CFPB that they are unable to monitor the student loan that they co-signed because loan servicers did not respond to their requests for help in accessing account information.

In other cases, older borrowers say that by the time the servicer sent them a notice of missed payments, the amount due had accrued fees and penalties. Some private student loan borrowers say they did not receive notice prior to a negative report to consumer reporting companies.

• Threatening to offset private student loan borrowers’ federally protected benefits: As noted in a Government Accountability Office report released last month, many older borrowers see a decline in their monthly Social Security benefits through garnishments or offsets to repay loans. According to that report, Social Security benefits of older American’s were garnished $171 million in 2015 to repay federal student loan debt.

However, the CFPB points out that certain federal benefits, like Social Security benefits, are protected from collection for defaulted private student loans. Yet, that hasn’t stopped some servicers from threatening to offset those benefits.

In the case of older consumers agreeing to be co-signers, the CFPB report found that many of these secondary borrowers are threatened with garnishment by servicers and debt collectors when the primary borrower does not provide payment.

In addition to releasing its report on older borrowers’ student loan debt, the CFPB unveiled four tips to help older student loan borrowers navigate the common problems uncovered in the complaints.

Consumer advocates applauded the CFPB on Thursday for highlighting older American’s struggles with student loans and the issues they face when repaying the debts.

“It is critically important that we ensure that consumers who are living on fixed incomes are given every opportunity to succeed, especially when it comes to paying loans designed to provide them or their children an education,” Odette Williamson, a staff attorney at the National Consumer Law Center, said in a statement. “This report shows that too often, the system is not working for older borrowers.”

NCLC also urged consumers facing difficulties with student loan servicing to share their stories with the CFPB’s complaint database.

Editor's Note: This article originally appeared on Consumerist.