Steve Beasant

Liberal Democrat Councillor for the East Marsh Learn more

Lib Dem conference adopts plans to abolish business rates

by Steve Beasant on 17 September, 2018

Today at conference, Liberal Democrats have voted for a comprehensive plan for replacing the broken business rates system.

The motion based on the report – Taxing Land, Not Investment – calls for the abolition of business rates and its replacement with a tax on land values, the Commercial Landowner Levy (CLL). The levy would remove buildings and machinery from calculations and tax only the land value of commercial sites, boosting investment and cutting taxes for businesses in nine out of ten English local authorities.

Key recommendations from the motion include:

- Business rates should be abolished and replaced by a Commercial Landowner Levy based on the value of commercial land only

- The levy should be paid by owners rather than tenants

- Non-residential stamp duty should be scrapped to improve the efficiency of the commercial property market

- Commercial land should be taxed regardless of whether the buildings above it are occupied; the tax should also apply to unused and derelict commercial land

The full report can be found here.

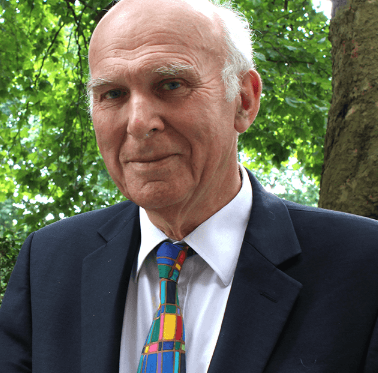

Li beral Democrat leader Vince Cable said:

beral Democrat leader Vince Cable said:

“Business rates were a badly designed policy to begin with and have become an unacceptable drag on our economy. They are a tax on productive investment at a time of chronically weak productivity growth, and a burden on high streets struggling to adapt to the rise of online retail.

“Many of the areas around the country that voted for Brexit feel they have been left behind. In place of policies the Brexiters offer only rhetoric. Great swathes of the country demand better, and this policy offers change to the manufacturing industry and the small towns passed over by economic growth.”

Founder of the Liberal Democrat Business and Entrepreneurs Network Andrew Dixon said:

“By only taxing land and not the productive capital above it, this reform would remove a major disincentive to investment, boosting productivity and contributing to a necessary revival in UK industry. While separate action is needed to ensure online retailers pay their fair share of corporation tax, our proposals would offer a lifeline to struggling high streets.

“I am delighted to support this initiative which I believe would boost business and enterprise across the UK, and I am grateful to members of the Liberal Democrats Business & Entrepreneurs Network for their valuable contributions to this important research”

Notes:

Conference notes:

A. That dissatisfaction with Business Rates has reached an all-time high, following a long-delayed and poorly implemented rates revaluation in 2017 and a deepening crisis on Britain’s high-streets.

B. Recent calls for reform of Business Rates from all the major business organisations, including the CBI, the FSB, the BCC, the BRC, the EEF and the IoD.

C. The recommendation in the IFS’s seminal 2011 Mirrlees Review that Business Rates should be replaced with a tax based on land values.

D. Liberal Democrats’ longstanding commitment to Business Rates reform, with a specific emphasis on replacing it with a land value tax.

Conference believes that:

i) By taxing business premises and equipment, Business Rates are a disincentive to investment, and are a particularly heavy burden on capital-intensive sectors such as manufacturing and renewable energy.

ii) It would be more efficient to solely tax the land value of commercial property, removing the disincentive to invest and enabling the state to better capture increases in land value driven by public infrastructure investment.

iii) By taxing commercial property transactions, Non-Residential Stamp Duty is an unwelcome burden on businesses that want to acquire or change premises, with the result that commercial property is not allocated efficiently.

Conference notes the proposals to replace Business Rates in the report Replacing the Broken Business Rates System: Taxing Land, Not Investment and calls for:

a) The replacement of Business Rates in England (currently set at a rate of 49.3p per pound) with a Commercial Landowner Levy (CLL) set at a rate of 59p per pound but based solely on the land value of commercial sites rather than their entire capital value, thereby stimulating investment, and shifting the burden of taxation from tenants to landowners.

b) The immediate abolition of Non-Residential Stamp Duty, thereby improving the efficiency of the commercial property market and making life simpler for businesses that want to own or change premises.

c) Ending discounts for empty and derelict premises and allowing councils to tax unfinished commercial developments beyond a reasonable construction period, increasing the supply of commercial property and reducing rents.

d) Abolishing the current system of Small Business Rates Relief – much of which is absorbed by landlords through higher rents – and replacing it with a doubled Employment Allowance, giving every employer a œ3,000 tax cut by reducing their National Insurance bills, and providing a boost to wages and employment.

e) Existing relief for agricultural land to be maintained; relief for charities to be protected except in the case of private schools and private healthcare.

f) Local authority revenues from Business Rates to be protected under the CLL through an adjustment to the redistribution formula, so that tax cuts for businesses do not mean lower revenues for those local authorities.

g) The transition from Business Rates to the CLL to take place over 4 years, with bills shifting gradually from a property to a land value basis and incidence moved to landlords when contracts are renewed or at rent reviews.

h) Annual revaluations of commercial land values by the Valuation Office Agency and the completion of a comprehensive and publicly-accessible Land Registry.

Conference further notes that:

1. Introducing the CLL would give businesses a net tax cut.

2. Under the CLL, business taxes would be lower in 92% of local authorities, helping to close Britain’s regional divide and alleviating the crisis on our high streets.

3. The majority of economic sectors would receive a boost under the CLL, with lower bills in manufacturing, hospitality and shops among other sectors.

4. Under the CLL, the 61% of small and medium sized businesses that do not own their own premises would no longer directly pay property tax, shifting the administrative burden of tax away from businesses onto a smaller number of commercial landlords, and saving both businesses and councils precious time and money.

Leave a comment

Leave a Reply